Justwealth Review 2025

Justwealth Review

-

Fees & Costs vs Mutual Funds

-

Investing Performance

-

Account Options

-

Financial Advice

-

Platform User Experience

Justwealth Review Summary:

I wrote my first Justwealth review back in 2015, and they’ve consistently gotten better with each passing year. What started as a solid financial advisory service (with a pretty dated website, to be honest) has grown into one of the most impressive digital investing platforms in the country. Their new app is slick, the interface is sharp, and the whole experience feels modern without losing that original personal touch and elite investing acumen.

What really sets Justwealth apart in 2025 is the rare combo of low fees, excellent long-term portfolio performance, and real, human advice. Every single client gets a dedicated financial advisor. No chatbots, no phone trees, just actual help from someone who knows your file.

They’ve also topped the MoneySense rankings this year. Justwealth consistently delivers the best portfolio returns of any Canadian robo advisor. That performance, paired with the tailored support and hands-off simplicity, is why I still consider them the best robo advisor in Canada.

Bonus: Justwealth is running the best robo advisor promo in Canada right now with up to $500 cash back just for signing up! Click here to get in on the offer.

Pros

- Easy to get started

- Run by Canadians – For Canadians!

- Incredibly convenient way to invest

- Excellent investment performance track record

- Best financial planning options amongst robo advisors

- Innovative RESP account options

- Personalized portfolio managers for every client

- Uses the best index ETFs regardless of provider

- Very safe and secure

- Up to $500 in promo bonus cash when you start

Cons

- Their website isn’t as bright and shiny as Wealthsimple

- $5,000 account minimum is a bit high (that minimum is waived for RESP and FHSA accounts)

Why Justwealth?

As I’ve updated my Justwealth review over the years, they have risen from a solid-but-not-elite option to the best robo advisor in Canada.

How did they do it?

By focusing on what matters.

Frankly, while Justwealth has made great strides in the way their website looks, they still aren’t the most aesthetically-appealing option out there. They aren’t taking your money and paying a giant team of coders to make and update some beautiful app or clever TV marketing campaign.

Instead, where Justwealth excels is in the nuts and bolts of solid financial management:

1) Great advice from your very own impartial financial advisor (assigned to you when you start at Justwealth).

2) By far the largest selection of robo advisor portfolios available in Canada.

3) Elite portfolio management from professionals with long-term track records within the industry – which has led to increased returns over time.

4) The only Canadian robo advisor to offer target-date RESP accounts.

Through focusing on the things that are important to Canadians – like better investment returns, more help, and way more options – Justwealth just offers an excellent way to grow your portfolio in a super simple and convenient manner. They don’t waste time and effort on making things fancy for the sake of being fancy.

Justwealth Welcome Bonus

Justwealth currently offers this promo offer to MDJ’s readers. Anyone who signs up using our links, can enjoy the following cash bonus when opening a new account:

- $50 for a deposit between $5,000 and $24,999

- $100 for a deposit between $25,000 and $49,999

- $225 for a deposit between $50,000 and $99,999

- $500 for a deposit of $100,000 or more

Best 2025 Canadian Robo Advisor Promo:

Up To $500 in Cash

Open an account with Justwealth and get the best robo advisor promo offer in Canada*.

Justwealth has the best portfolio performance out of all Canadian robo advisors + the best promo offer. Get it by clicking the button below:

* Based on investment amount ** Applies only to New clients who open and fund a new account. *** Justwealth Review: more details.

Justwealth Investment Performance (Best Returns in Canada)

If you want to know more about how robo advisors work and why I think they have a well-deserved place amongst Canadian platforms, check out my article about the best robo advisors in Canada.

Long story short, robo advisors are the quickest and most convenient way to take a part of your paycheque and turn it into an instantly-diversified investment portfolio. The fees are WAY lower than traditional mutual funds and the basic index investing approach using index ETFs is an excellent strategy for the average person to invest.

That value proposition is consistent across basically all of the robo advisors (save for possibly Questrade’s Questwealth robo advisor which uses more active management strategies).

Here’s the thing though, even within broad indexing investment strategies there are some key differences in how the robo advisors invest your money. The big things are pretty close to the same. For example, all robo advisors:

1) Use ETFs which are passively managed. No one within these ETFs is buying and selling individual stocks or bonds “trying to get an edge.”

2) The ETFs that are used are much cheaper to invest in than Canada’s mutual funds – which results in a much, much higher probability that your investments will grow over time.

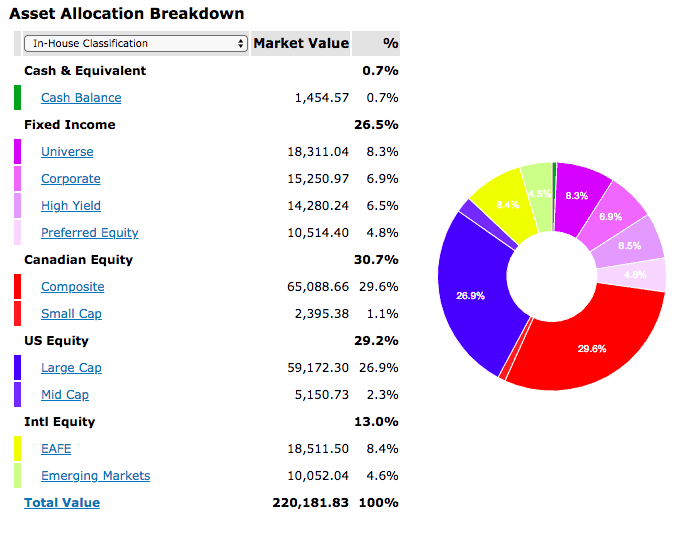

3) Use one ETF to invest your money into each type of asset. So perhaps there is one ETF for Canadian stocks, one ETF for American stocks, one ETF for emerging markets, one ETF for stocks in developed markets that aren’t Canada and the USA, and maybe one or two ETFs for bonds.

That basic structure doesn’t change when it comes to Justwealth. But – and this is key – what is different is the exact ETFs that Justwealth selects, as well as the amount of each ETF that they hold in your specific portfolio.

Justwealth has said from Day 1 that they are “more FIN than TECH” when it comes to being a fintech company. They have proven that this is true by having a durable competitive advantage when it comes to portfolio composition.

Most robo advisors are either owned by a big parent company, or have a side deal with a large ETF company. Those deals and ownership structures mean that their robo advisors use exclusively the ETFs put out by the parent company or partner company – even if there is a better ETF available that covers the same asset class.

Justwealth is a fully independent firm, and consequently can choose the best ETF available in each asset class no matter what company has created the ETF. These small advantages – along with superior risk management – has allowed Justwealth to achieve the best after-fee returns of any of Canada’s robo advisors and bank mutual funds (as you can see below and as reported in the Globe and Mail).

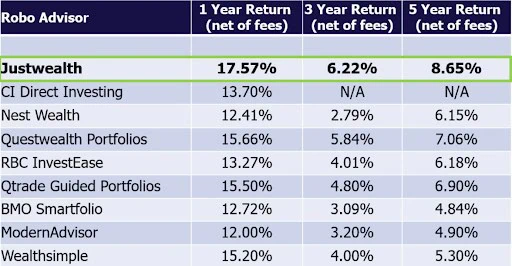

Justwealth vs other robo advisors (For High Growth Portfolio for period ending Sept 30, 2024, per Globe & Mail)

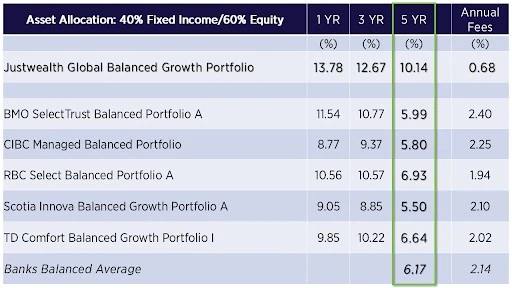

Justwealth vs Bank Mutual Funds (Balanced – for the period ending June 30, 2025)

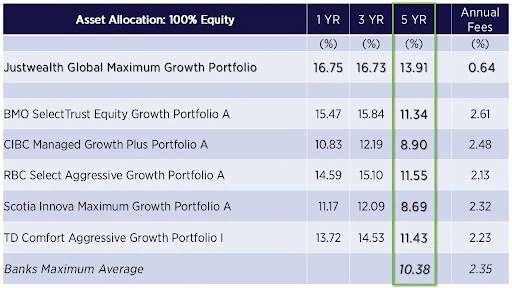

Justwealth vs Bank Mutual Funds (Aggressive – for the period ending June 30, 2025)

The first thing to note here is just how awful the performance has been amongst those actively managed bank portfolios compared to the robo advisors. This isn’t an accident! The twin issues of terrible active management combined with crazy high fees are going to lead to bank mutual funds ALWAYS losing over a long enough time period.

When it comes to Justwealth’s outperformance vs Wealthsimple (Canada’s most popular robo advisor) Rob Carrick wrote in regards to Wealthsimple that the “Performance of its robo advisor portfolios does not impress.”

The truth is that Wealthsimple has changed their portfolio allocation multiple times, making pretty ridiculous mistakes when it came to bond allocation strategies and adding in gold exposure (amongst other errors). They’re now focusing on cross-selling risky crypto assets and doing all kinds of other useless promotions in their focus on the bottom line.

Ben Felix has also written in the Globe and Mail about the mistakes that Wealthsimple has made over the last five years, and details all the tinkering that the company has done (thus indicating that they don’t have faith in their initial “set-it-and-leave-it-alone” investing philosophy).

These returns don’t include the added tax advantages that Justwealth brings to the able in the form of tax-loss harvesting and the fact that they understand the differences in which optimal assets to hold in a registered account (like an RRSP, TFSA, or RESP) versus a non-registered account.

Is Justwealth Safe?

Absolutely! When it comes to financial security, Justwealth is as safe as any other regulated investment institution in Canada.

Justwealth takes cybersecurity and fraud protection seriously. Your investments are held securely and are protected under the Canadian Investor Protection Fund (CIPF), which covers up to $1 million CAD per account type in the unlikely event of insolvency. This means that if anything were to happen to Justwealth’s custodian, CI Investment Services Inc. (formerly BBS Securities Inc.), your money would still be protected.

Note: It’s extremely unlikely things would even get to this point as if something ever happened to CI’s balance sheet, it is illegal for them to reach into clients’ accounts to get money. If they weren’t performing as a business, what would happen is another robo advisor or custodian would likely step in and buy out CI – transferring your account over to them. Of course you could also choose to leave at any stage.

Beyond insurance coverage, Justwealth operates under strict regulatory oversight, ensuring that your investments are handled with the highest level of security and compliance.

Fiduciary Duty vs. Commission-Driven Advice: Here’s where Justwealth sets itself apart from most of the “financial advisors” working at Canadian banks and credit unions: they are legally registered as a Portfolio Manager.

What does that mean? It means Justwealth has a fiduciary duty to act in your best interest at all times. They can’t push you into investments that make them more money at your expense. That’s a massive difference from many traditional financial advisors, who are often just salespeople in disguise, earning commissions by selling high-fee mutual funds or proprietary investment products.

It’s shocking, but in Canada, the term “financial advisor” has no legal definition. Anyone can call themselves a financial advisor, regardless of training or credentials. In contrast, a Portfolio Manager (like Justwealth) must meet strict industry qualifications and operate under a legal obligation to prioritize your financial well-being.

Finally, Justwealth takes cybersecurity very seriously, employing bank-level encryption and industry-leading security protocols to ensure your personal and financial information stays protected at all times.

Justwealth uses 256-bit SSL encryption, the same level of security employed by Canada’s largest banks. This ensures that all communication between your device and Justwealth’s servers is encrypted, making it nearly impossible for hackers to intercept sensitive information. Additionally, all transactions and logins can be secured with available multi-factor authentication (MFA), adding an extra layer of protection beyond just your password.

As a registered Portfolio Manager with Canadian regulatory bodies, Justwealth must meet strict compliance requirements for data security and investor protection. They adhere to Personal Information Protection and Electronic Documents Act (PIPEDA) standards, meaning your personal data is handled with the highest level of confidentiality and protection.

Additionally, Justwealth’s platform undergoes regular third-party security audits, ensuring their infrastructure remains up to date with the latest industry security standards.

All that to say – Justwealth is incredibly safe to use.

Justwealth Fees

Every robo advisor (including Justwealth) has two layers of fees:

1) The fees that they charge you in order to make money as a company. These are usually called the company’s management fee, and it is expressed as a percentage of the amount of money you currently have invested.

2) The fees that the investment companies that create the ETFs charge you. These fees are also referred to as management fees – or Management Expense Ratios (MERs).

Justwealth’s management fee of 0.40% to 0.50% is very competitive with their competitors – and MUCH lower than what Canadian mutual funds charge!

FHSA accounts are treated the same way as RESP accounts in terms of minimums.

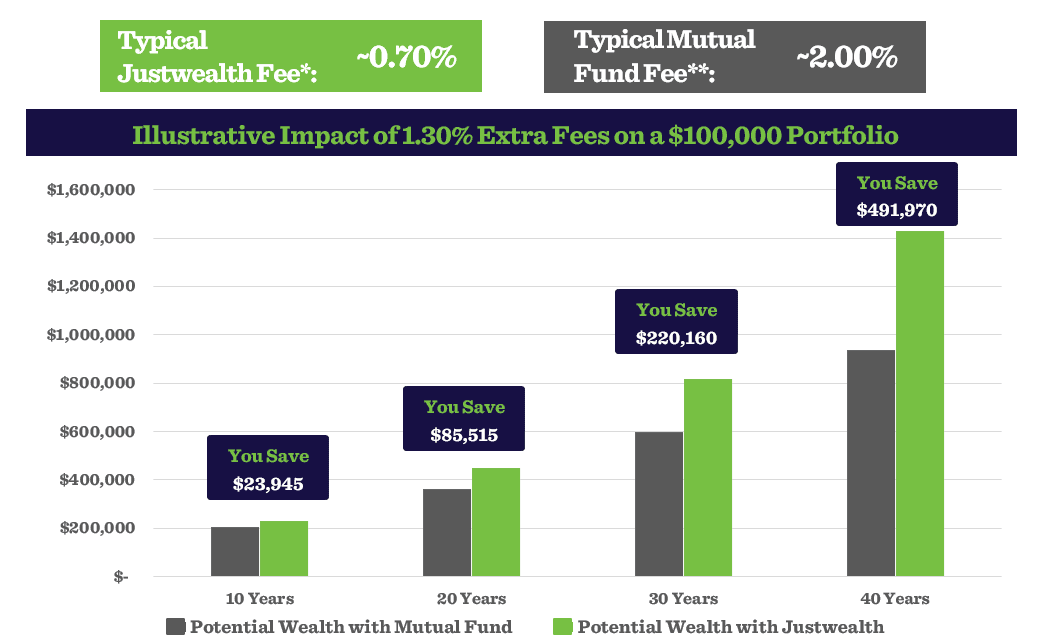

Depending on what portfolio(s) you select for your nest egg, the ETF fee will probably be in the 0.15%-0.25% range. That means the total fees that you’ll pay will be 0.55%-0.75%. That difference vs the traditional mutual funds that your bank or credit union is pedaling adds up in a hurry (as you can see below)!

Justwealth Review: Financial Planning

One of the massive advantages that Justwealth has over most other Canadian robo advisors is that they offer a much more comprehensive financial planning aspect to their services.

Here’s the deal: Most robo advisors will claim that they have some version of financial planning available. From what I’ve personally experienced, and from the feedback I’ve gotten on hundreds of website comments and emails over the last eight years, I know that what that “financial planning” promise actually means in practice can vary widely.

To be fair, every robo has some version of “email us or jump on a chat and we’ll answer your straightforward question about how to use a TFSA or RRSP – or something similar.”

Justwealth takes it to another level though. Right from Day 1 you get a dedicated Personal Portfolio Manager (who has a fiduciary responsibility to you). This person will guide you through tax-efficient portfolios, tax-loss harvesting, and explain any rebalancing moves that have been made within your account.

The only other robo advisor in Canada that offers anything like this is CI Direct (the former Wealthbar) – and they don’t offer nearly the account options or investment returns that Wealthbar does.

There is substantial value in having someone available to answer questions, and who is personally familiar with your needs and portfolio goals. This planning help – along with the sheer ease of getting started – are the main reasons someone might choose to go with a Justwealth portfolio as opposed to DIYing it with an all-in-one ETF.

So what does having a dedicated Personal Portfolio Manager and a support team – with a fiduciary obligation – mean?

It means that when Justwealth assigns you a portfolio manager and team, that team is obligated to put YOU first. Not Justwealth, not anything that may benefit them, but you and your specific needs. Justwealth Portfolio Managers are registered with a provincial Securities Commission as an Advising Representative. This requires a high degree of qualifications, experience, and the duty to act with honesty, care, and in the best interest of your client.

Justwealth vs Wealthsimple

All cards on the table here, I was previously a big fan of Wealthsimple, and as Canada’s largest robo advisor they obviously still have a lot going for them. Their user interface, and the simple beauty of their design is simply the prettiest online platform I’ve ever interacted with.

That said, they’ve made some pretty big errors over the last few years, including:

- Shifting their focus away from the Wealthsimple robo advisor (known as Wealthsimple Invest) to higher-profit areas like trading cryptocurrency.

- Encouraging customers to trade in risky new areas like private credit and crypto as opposed to keeping things simple with a focus on basic index investing principles.

- Making some really rookie mistakes when it comes to bond ETF selection.

- Including gold in their portfolios (gold is an awful long term investment).

- Not adding more customization to their 3 Wealthsimple Invest options (Justwealth has over 80 unique portfolios available for you).

So given all of those facts, it was simply impossible to keep them in the top spot. Here’s the direct Wealthsimple vs Justwealth comparison:

|  | |

|---|---|---|

| Available portfolios |

|

|

| 5 Year Returns (Balanced Portfolio) | 5.30% | 8.65% |

| Fees | 0.40% - 0.50% |

|

| Account Minimum | None. | $5,000 (With exceptions for RESP and FHSA accounts). |

| SRI Options | Available | Available |

| Current Promo | $50 Sign-up Bonus. | $100-$500 Instant Cash Back. | Sign Up | Visit Wealthsimple & Get $50 Free | Visit Justwealth |

*5-year return numbers are taken from Moneysense as a neutral 3rd-party comparison

A Peek Inside Justwealth

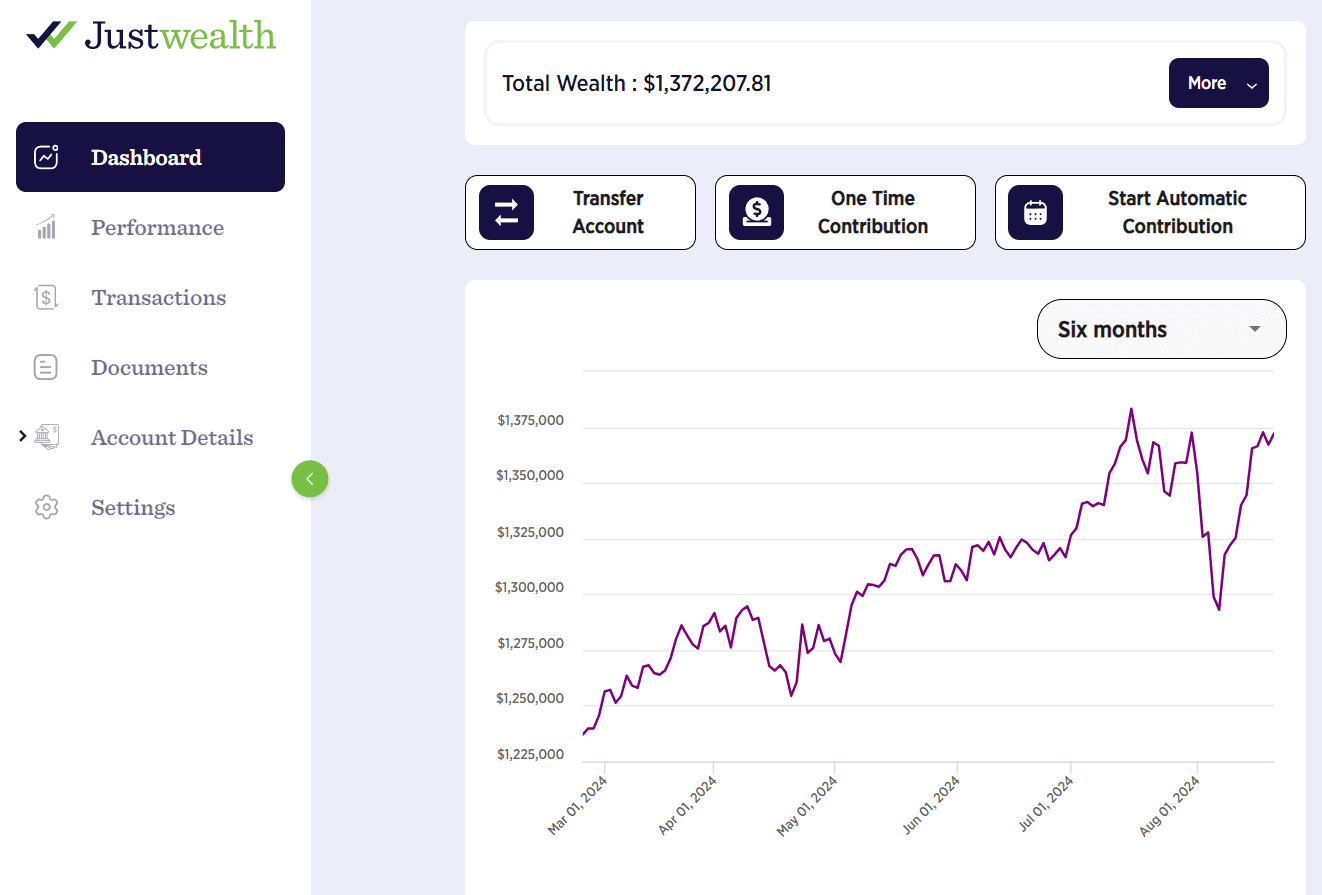

Justwealth Mobile App Review

Over the last two years, the Justwealth app continues to maintain an excellent 4.7 star rating in the Apple App store.

Much like their website, it’s not the fanciest app that you’re likely to see, but you can do the following fairly easy:

- Check the current value of your portfolio.

- See your transactions.

- Add or withdraw funds.

- Set-up an auto-contribution plan for the ultimate convenience.

- Create a new investment account.

How to Open a Justwealth Account

to make sure you get your bonus cash, and 10 minutes later you should be well into the process of selecting which portfolio(s) work best for your cash.

- Your social insurance number.

- Your main chequing/current account information (route and transit number can be found on a cheque or on your online banking profile if you go to the “cancelled cheque” option).

- Photos (both sides) of government-issued ID such as a passport or drivers license.

You’ll then be asked for some information on your employment, finances, and investing experience in order to streamline you into the best possible option for your unique situation. You can e-sign most account forms while onboarding, making the process much faster than it used to be to open an investment account.

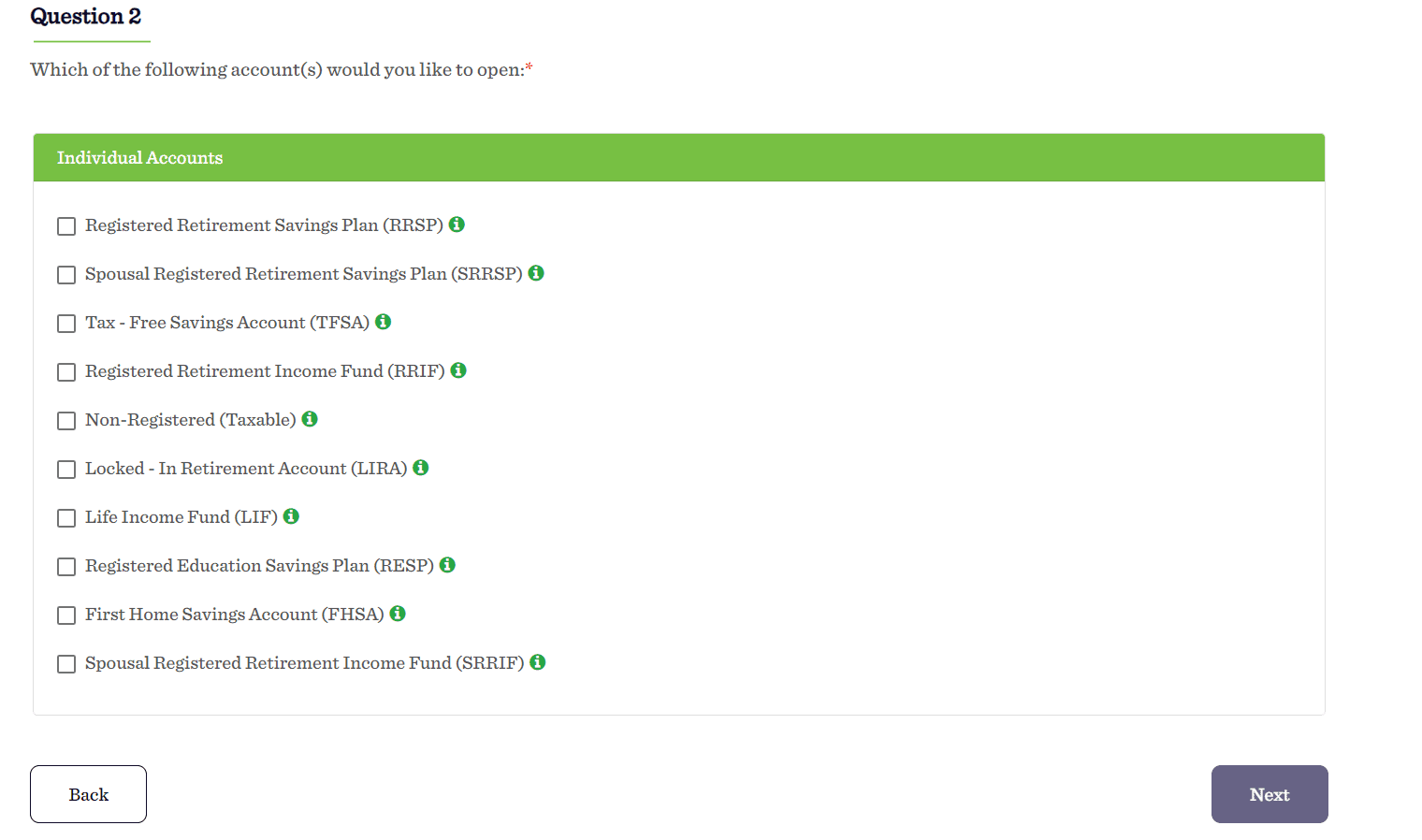

Justwealth Types of Accounts

Justwealth offers the typical accounts that you would expect from a robo advisor. These are:

- RRSP

- Spousal RRSP

- TFSA

- Non-Registered account

- RRIF

- FHSA

- RESP

- LIRA

- LIF

*You can also open a US dollar account for some of these options.

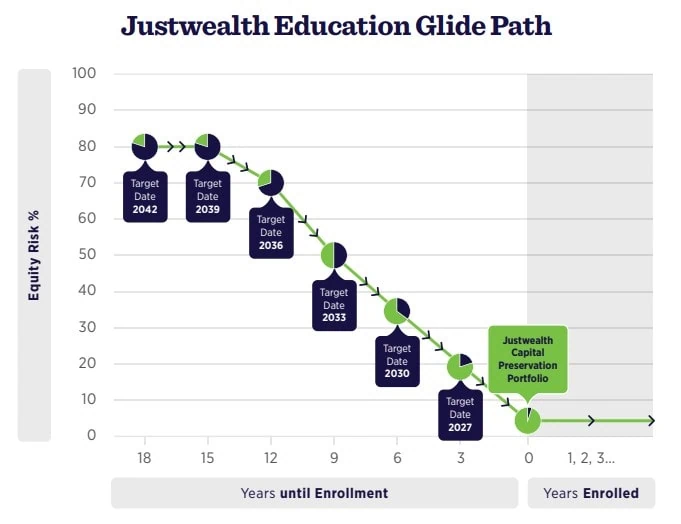

Right now, they are the only online investment manager in Canada that offers Education Target Date Portfolios. They are designed to grow with your child and automatically rebalance as the target date approaches. This means that by the time your child graduates, the money will be ready for them. Another perk of the Justwealth RESP is that there is no minimum requirement to open this type of account.

As for other Justwealth accounts (with the exception of FHSA accounts), the minimum amount to get started is a hefty $5,000. While this might be fine for someone transferring an account, it’s a large sum for anyone younger and just starting out. This is a big drawback in my eyes, especially when other robo advisors including Wealthsimple have no minimum requirement.

Justwealth Review: The RESP Advantage

Perhaps the product that most put Justwealth on the map was their RESP portfolio. Even though it has been much-commented on by Canadian financial writers, no other robo advisor has rolled out anything similar.

The idea is pretty cool. Essentially, what Justwealth did was take the target date fund idea and adapt it to RESPs. Target date funds are structured so that as investors get closer to retirement, their investment portfolio automatically shifts to less and less risky assets – no need for the investor to worry about what the right balance is or anything else.

Justwealth’s RESP funds are basically the same premise. If it’s still 10+ years before your little one is headed to college or university, then you can afford to take a little more risk in your portfolio, whereas if they’re off to the ivory tower next year, then you probably don’t want to be taking much risk at all. Justwealth will handle that transition with their target date fund.

As you can see above, you simply select the target date that your child will be headed to university, and Justwealth will slowly move you from a portfolio that has more-stock-and-less-bonds to a portfolio that doesn’t include any stocks at all because you’ll be using the RESP money in the next few years.

If my parents would have used this type of account instead of a basic high interest savings account option that was the default at their bank (and which the bank no doubt made a lot of money off of) I would have went to school with thousands of dollars more in my RESP accounts (somewhere around 40-60% due to how well Canadian stocks did between 1995 and 2009).

Justwealth FHSA Account

In 2023 the Federal Government introduced the First Home Savings Account (FHSA) and Justwealth was one of the first robo advisors to offer an FHSA account. Here’s a quick look at the rules behind the Justwealth FHSA Account:

- Applies to Canadian residents aged 18-71 who didn’t live in a home they (or their spouse) owned in the last four years

- You can contribute up to $8,000 per year, to a maximum contribution of $40,000 over 15 years

- The annual deadline to contribute is December 31st

- You have 15 years from the day you open the account to use your FHSA to purchase your first home

- Contribution room only starts being available in the year you open your account

- Only $8K of unused contribution room carries forward in any year, so you can never have more than $16,000 of contribution room

- Your investment grows tax free as long as you purchase a qualifying first home – if you don’t end up buying a home, you pay tax on the gains, or you can transfer the money to your RRSP without affecting your RRSP contribution room

Justwealth is unique amongst robo advisors in that they already had the perfect solution for FHSA accounts due to their creation of target-date RESP accounts. The principle of adjusting risk in regards to your time horizon is very similar between an RESP and an FHSA.

If you are likely to need the money in 3 years or less, you want to be in extremely conservative investments. If you’re 10+ years away from needing access to your capital, then it is statistically very likely you’d be best served by an account that balances stocks and bonds a little more.

What ETFs Does Justwealth Use?

Justwealth prides itself on using the best ETFs in their portfolio – regardless of which company creates them.

That’s a key distinguishing feature from other robo advisors who often only use in-house ETFs (for example BMO Smartfolio is going to use mostly BMO ETFs) or ETF providers who they have a commission-based agreement with – even if those ETFs aren’t “best in class”.

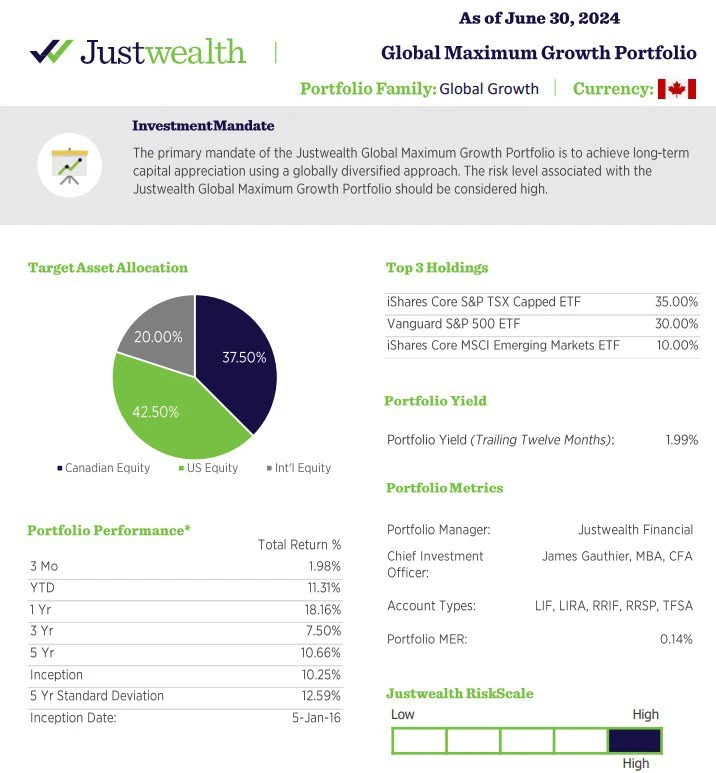

By looking at your fund’s little information profile (like the Global Growth Portfolio below) you can see exactly what ETFs your money will be invested into as well as the most relevant portfolio metrics such as yield, account compatibility, and MER.

In my opinion, not being limited to specific ETF partners is a major advantage for Justwealth and gives them a credible way to say that they are the only robo advisor that is not handcuffed to some degree in their quest to get the best possible ETF for their portfolio.

Who Is Justwealth?

While Justwealth has made big strides on the tech front in recent years (including major platform upgrades in both 2023 and 2024), at its core, this is still a financial planning firm – not a tech startup with a finance add-on.

Yes, they now have a full-time Chief Technology Officer, and yes, the app and website are vastly improved. But the real strength of Justwealth lies in its people and their focus: building smart portfolios and giving clients personalized advice.

I pulled a few bios from Justwealth’s About Us page to give you a sense of who’s actually running the show.

President and co-founder Andrew Kirkland is a Certified Financial Planner and Chartered Investment Manager, with more than 15 years of experience guiding Canadians through the world of investing.

Then there’s James Gauthier, Justwealth’s Chief Investment Officer and the brains behind their asset allocation strategy. James has been designing portfolios for over 25 years, holds the Chartered Financial Analyst designation, and has built a reputation for delivering top-tier performance. If you’re wondering why Justwealth keeps topping performance charts year after year, James is a big part of that story.

Rounding out the team is Richard Burton-Williams, who brings global perspective thanks to his MBA from the University of Chicago’s Booth School of Business (one of the top finance programs in the world).

Bottom Line: This isn’t some flashy fintech operation led by crypto bros and marketing grads. These are seasoned investment pros who’ve spent their careers helping Canadians match smart portfolios with their personal financial goals.

Justwealth Corporate Accounts: A Smart Fit for Business Owners

Justwealth’s Corporate Account is built with incorporated professionals and small-to-mid-sized business owners in mind. It is especially useful to Canadian business owners with surplus cash sitting idle in a corporate bank account. Whether you’re a doctor, dentist, consultant, or running another incorporated business, parking retained earnings in a low-interest savings account is a missed opportunity.

With Justwealth, you get the combination of a dedicated portfolio manager and an easy, automated investment platform designed to maximize after-tax returns. The onboarding process is quick and user-friendly, and your advisor will tailor a low-cost ETF portfolio to your business’s goals, cash flow needs, and investment horizon. That portfolio will be monitored and rebalanced automatically, while still giving you direct access to experienced investment professionals.

Corporate accounts function much like a non-registered investment account, except they’re held in the name of your corporation. The main tax wrinkle to keep in mind is that passive investment income above $50,000 per year will start to erode your Small Business Deduction. It’s a bit complicated, but you can read more about it here in my article on Canadian-Controlled Private Corporation Taxation. Justwealth’s tax-efficient portfolios help mitigate the erosion of that business deduction by keeping turnover low, using smart asset location, and focusing on long-term growth rather than short-term trades.

Compared to the average Canadian mutual fund fee of about 2%, Justwealth’s all-in cost of roughly 0.70% (0.50% management fee + 0.20% ETF MER) leaves far more money working in your corporate account. Over 30 years, that 1.3% fee savings will translate into hundreds of dollars in after-tax wealth that you can use to supercharge your retirement.

And because corporate investing comes with extra record-keeping headaches, Justwealth provides clear statements and tax documents that make life easier for your accountant. You can even consolidate your corporate account with your personal TFSA, RRSP, or other non-registered accounts to keep your financial picture simple and cohesive.

For business owners looking for a hands-off, tax-efficient way to grow retained earnings, the Justwealth Corporate Account is tough to beat. The company was built by Canadian small business owners, and they clearly know the long-term worth of having fellow CCPC owners as clients.

Justwealth’s Portfolio Review Service

If you want to take a test run on the kind of customer service and financial expertise that you’ll be getting with Justwealth I recommend checking out their free portfolio review service. As far as I’m aware, they’re the only Canadian robo advisor to offer such an interesting free look at your current investments.

The idea is that you submit a look at your current investments, and in a couple of days you’ll get a report from one of Justwealth’s portfolio managers that outlines how your current portfolio stacks up in the areas of fees, investment diversification, account structure, and tax efficiency.

If you’re a longtime MDJ reader then chances are there won’t be much in there that you weren’t aware of already, but I reckon for most Canadians that have been getting their investments and advice from Canadian banks and credit unions, they might be in for a bit of a shock.

Justwealth Review: Is It Right for You?

As you’ve probably gathered from this in-depth Justwealth review, I’ve been genuinely impressed with how far this company has come over the past eight years.

Now, if you’re someone who actually enjoys researching ETFs, fine-tuning allocations, and manually rebalancing every few months, then a self-directed brokerage might still be your best match.

But let’s be honest – most Canadians aren’t looking for a side gig as a portfolio manager. What they really want is a smart, set-it-and-forget-it solution that skips the high fees, ditches the sales pitches, and still comes with real financial guidance.

And if it also helps with tax optimization?

Even better.

That’s exactly where Justwealth shines. It’s a low-maintenance, high-trust way to grow your wealth in the background, with minimal effort and maximum peace of mind. Once your account is set up and your contributions are automated, you’re done. No more stressing about market moves, second-guessing your decisions, or scrambling at RRSP deadline time.

The target-date RESP options and consistent portfolio outperformance are enough to really put Justwealth ahead over every other robo option in Canada.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Interesting review. While their services are offered offered in Quebec, I unfortunately can’t find a French version of their site. I find it easier to handle financial matters in my monther tongue.

Interesting observation. Are you some kind of algorithm programming expert to know their algorithm that well to make that kind of comment, or an expert on custodian knowledge? Justwealth may not have the flashiest website, but I have not experienced any problems or errors and their performance is light years ahead of Wealthsimple and that is why I left Wealthsimple for Justwealth!

If you want real automation and advanced technology, Justwealth is NOT for you. Their systems are very outdated, including the algorithm they use to make portfolio recommendations. They and their custodian make constant mistakes, so you can expect to see charges, fees, withdrawals etc on your account that shouldn’t be there. They always get fixed, but they happen way too often. I switched to Wealthsimple and was truly baffled by how much easier and faster it was.

My husband and I are retired since +20 years ago when we were in our early 50’s (we’re early advocates of the FIRE movement!) About 3 years ago, we’ve switched our 7-figure multi-accounts to JustWealth after literally months of research (we’ve checked all the available robots out there at the time.) Previously, we have been with an “ABC” bank financial advisor for about 15 years. During the last 2-3 years with them, we’ve noticed they changed their approach, and were answering less and less questions from us about managing our retirement needs. They were not really transparent about what they bought, and why, or even how much commissions they made. They “made us” buy mutual funds with an average of 2.5% fees. When we ask our financial advisor why such high fees, his reply was, “You have more money now because your accounts are growing, and that’s what counts!” Period. Finally, we decided to make the jump to a “robo-advisor”, JustWealth (we really took a chance here), but only to be pleasantly surprised to find out that with them we had the bonus of having a personal financial advisor. Lo and behold, that person (James Gauthier, among others) was answering all of our questions, including investment choices, bonds, markets, etc., and they were even very helpful when we had to renew our mortgage. We can only give them praise for their professionalism and outstanding management, …and also for having improved their website (it was needed!) We’re just regular retired folks, and we rarely give our opinions online, but this time we felt it was well deserved. And, no, we’ve not been paid to write the above statement! It’s only out of pure satisfaction… so far so good!

Really appreciate you taking the time to write that enlightening comment Jackie! When I read/hear about advisors saying things like “You have more money now… that’s what counts” it boils my blood. I don’t know how these people legally get away with saying stuff like that. Congrats on being FIRE pioneers!